There are many reasons why interest is haram, or forbidden, in Islam. First and foremost, Allah, or God, has prohibited us from taking or giving interest in the Quran. This alone should be enough for Muslims to avoid interest. However, there are also many practical reasons why interest is haram. For example, interest can lead to inflation, which hurts everyone, but especially the poor. It can also lead to a cycle of debt that is difficult to break out of. Finally, taking or giving interest is simply not fair – it’s exploiting people who are in a vulnerable position.

There are a few reasons why interest (riba) is haram in Islam. First, it is seen as a form of gambling, which is prohibited in Islam. Secondly, it creates an unfair system where the rich get richer and the poor get poorer. Finally, it is a means of exploiting others, which goes against the principles of Islam.

Why is interested prohibited in Islam?

The prohibition of interest in Islam is based on the belief that charging interest from someone who is forced to borrow to meet his essential consumption requirement is considered as an exploitative practice. Charging of interest on loans for productive purposes is also prohibited because it is not an equitable form of transaction.

Interest is considered haram in Islam, which means it is forbidden and should be avoided at all costs.

Whilst it is relatively easy to avoid charging interest (simply by not asking for it), in the modern-day, it is increasingly more difficult for Muslims to abstain from making interest payments.

This is because many financial products and services contain some form of interest. For example, when taking out a loan, paying credit card interest, or earning interest on savings accounts.

To avoid paying interest, Muslims need to be aware of which financial products and services contain interest, and look for alternatives that don’t. This can be a challenge, but it is important to remember that interest is haram and should be avoided at all costs.

Is riba worse than Zina

The Islamic prophet Muhammad declared the practice of riba worse than “a man committing zina (fornication) with his own mother”. In that hadeeth, he said that there are 70 sins of riba. This demonstrates how seriously Islam views the act of riba, and how it is considered far worse than even the most heinous of crimes.

Islamic laws on usury are designed to protect against inequality and unfair wealth hoarding. Lenders and investors are not allowed to earn interest on their investments, as this would be a way of collecting unearned wealth and enriching oneself at the expense of others.

How to avoid interest in Islam?

There are a few key things to consider when deciding whether to rent or buy a home. First, you need to consider your financial situation and whether you can afford the monthly payments of a mortgage. If you’re not sure, you can speak to a financial advisor to get a better idea.

If you do have the financial means to buy a home, you then need to consider whether you’re ready to commit to a long-term mortgage. Buying a home is a big financial and lifestyle commitment, so you need to make sure you’re ready for it.

Another thing to consider is whether you’re likely to move in the near future. If you think you might need to move for work or family reasons, renting might be a better option as it’s easier to break a lease than to sell a home.

Ultimately, the decision of whether to rent or buy a home comes down to personal preference and circumstances. There’s no right or wrong answer, so it’s important to weigh up all the pros and cons before making a decision.

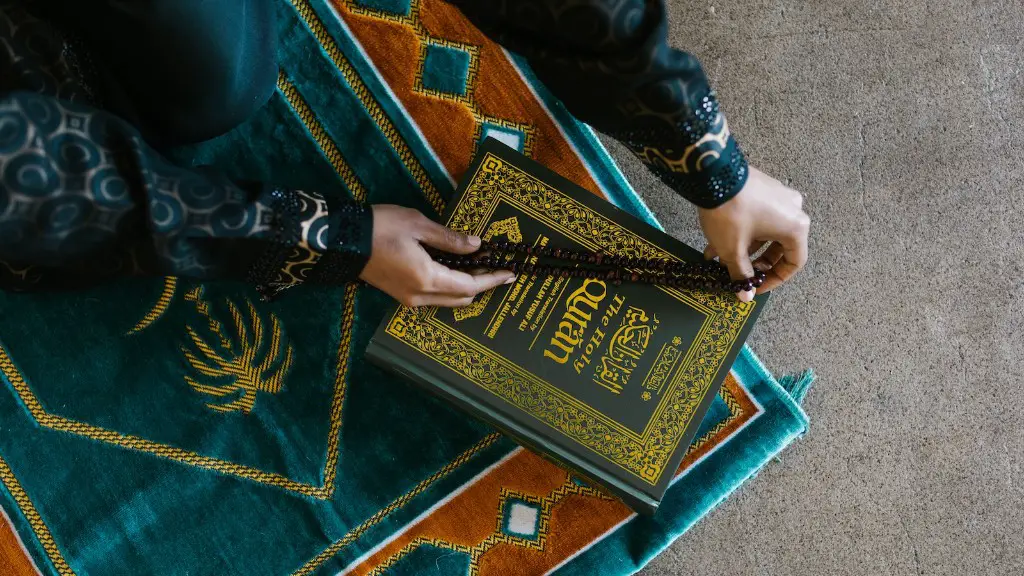

It is permissible to recite the Quran while a person is standing, lying on his bed or in other positions. This shows that Islam is a religion of ease and flexibility.

What is one of the biggest sin in Islam?

One of the major sins that is considered as al-Kaba’ir is the act of shirk. Shirk is the act of associating others with Allah or worshipping anyone or anything other than Him. This is a major act of disobedience and is punishable by Allah.

The Islamic legal tradition treats any sexual contact outside a legal marriage as a crime. The main category of such crimes is zina, defined as any act of illicit sexual intercourse between a man and woman. Zina is a serious offense under Islamic law, and those convicted of it can face significant penalties, including imprisonment and even execution. While the Islamic legal tradition does not condone extramarital sexual activity, it does recognize that such activity may sometimes occur. In cases where it does, the law seeks to ensure that the individuals involved are punished appropriately.

What kind of riba is haram

The Prophet, on him be peace, specified as a haram, or forbidden, business transaction Riba Al-Fadl is the unequal exchange of like commodities. This means that if someone is selling a commodity for more than it is worth, or buying it for less than it is worth, then they are engaging in Riba Al-Fadl. This type of Riba is forbidden in Islam, and those who engage in it will be punished in the hereafter.

In Islamic finance, riba refers to interest charged on loans or deposits. Religious practice forbids riba, even at low interest rates, as both illegal and unethical or usurious. Islamic banking has provided several workarounds to accommodate financial transactions without charging explicit interest.

What religion can’t earn interest?

Shariah is the Islamic legal system that governs all aspects of Muslim life. It is based on four primary sources: the Quran, the Hadith, ijma (the consensus of Islamic scholars), and qiyas (analogical reasoning). Shariah law prohibits the primary element of most loans: interest. This is because Islam views interest as a form of exploitation, and it is therefore not permissible. There are a few exceptions to this rule, but generally speaking, Shariah-compliant loans will not have any interest involved.

A shari’ah-compliant current account is one that does not pay interest. Instead, in return for having ready access to your money, the bank uses the deposit you give as an interest-free loan. This loan is known as a “qard.”

How do I clean my riba money

By donating Riba to charity, Muslims are able to cleanse their wealth and get rid of the haram Riba in a way that does not personally benefit themselves. Although rewards will not be received for doing so, this is still an acceptable way to spend Riba according to Islamic law.

If you start thinking about something haram, turn to Allah immediately and redirect your thoughts. Recite istighfaar to purify your thoughts, and your actions in turn will be pure. Change and replace your thoughts to enjoy the halal aspects of life, and not crave for the haram.

What is an example of riba?

A conventional mortgage is a loan that is not insured or guaranteed by the government. A car loan is a loan used to purchase a vehicle. A student loan is a loan used to pay for educational expenses. Riba al-nasee’ah is the charging of interest on loans. Riba al-nasee’ah is so odious that the other types of riba are prohibited simply because of the possibility that they may lead to riba al-nasee’ah.

The prophet has said that one should not sleep before the night prayer, and that discussion should not happen after the prayer. This is because Muslims are required to wake up for Fajr prayer, which is about one hour before sunrise. The prophet himself did not sleep after Fajr prayer.

Final Words

The Quran prohibits the charging of interest on loans, stating that it is “better for you” not to lend money at interest “that you may not taste of other people’s money” and so that “you may not suffer a loss”. In Islam, money should be seen as a means of exchange and not as a commodity to be bought or sold for profit. The charging of interest is seen as a way of exploiting the weak and vulnerable, and as a result, is not permitted.

The conclusion is that interest is haram in Islam because it is a form of gambling and it is not permissible to gamble in Islam.