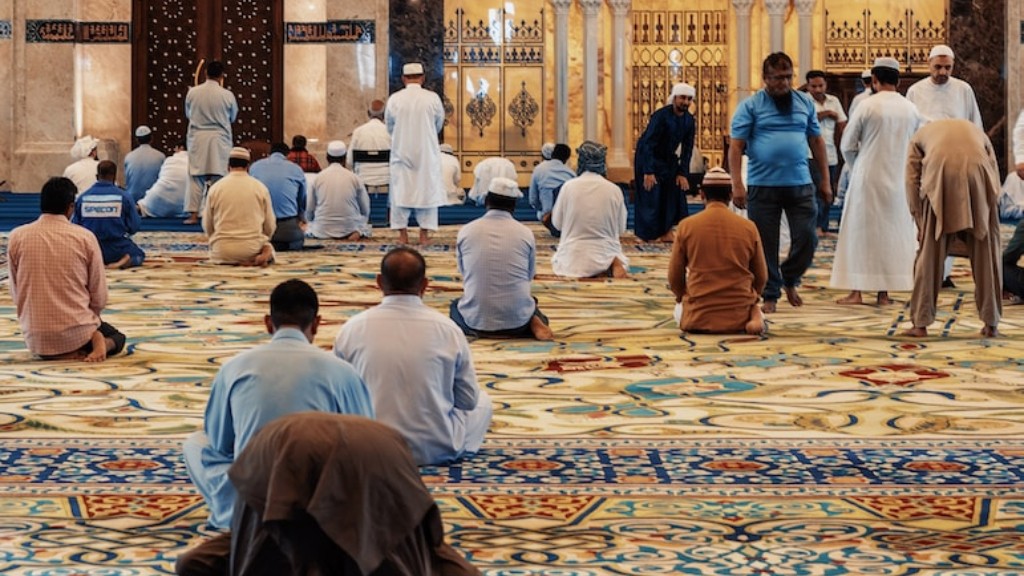

Islam is a religion that encompasses a wide range of beliefs and practices. One of the key tenets of Islam is the prohibition of interest-based transactions, which has led some to believe that investing is haram (forbidden). However, there is a significant amount of debate on this issue amongst Islamic scholars, with some arguing that investing is permitted if done in a certain way. Ultimately, the decision of whether or not to invest is a personal one that must be made in accordance with one’s own religious beliefs and practices.

There is no right or wrong answer to this question as it depends on the interpretation of Islam. Some people may believe that investing is haram because it involves taking risks with money, which is considered to be a sacred resource. Others may believe that investing is permissible because it can lead to positive outcomes, such as financial security and growth. Ultimately, the decision of whether or not to invest should be left up to the individual.

What is a haram investment in Islam?

The Islamic principles of avoiding debt and usury make investment in bonds and other debt securities that generate interest income prohibited (haram). This is because such investments would be exploitative of the debtor, and would thus go against the Islamic principles of fairness and justice.

There are certain conditions that an investment company must fulfil before a Muslim is allowed to invest. If the investment company fulfils them, then it makes the mutual fund halal.

Is it haram to invest in a company

In general, investing in company shares is permitted in Islam in a sense that it is like partnership business or mudarabah contracts which is permitted in Islam. The Islamic jurists agreed upon the permissibility of partnership business and mudarabah contracts (Al-Kasani, 1983).

However, there are some conditions that must be met in order for such an investment to be permissible. Firstly, the company must be engaged in a lawful business. Secondly, the company must not be involved in any prohibited activities such as gambling, alcohol, etc. Finally, the investor must have a clear understanding of the company’s business model and operations.

Yes, Tesla is a halal stock as its interest-bearing debt does not exceed 33%. On the other hand, the illiquid to total assets ratio is greater than 20%, which complies with the shariah screening principles.

Is Bitcoin is halal?

According to the Sharia Review Bureau in Bahrain, investments in cryptocurrencies like ether (ETH) and bitcoin are permissible under Sharia law and hence halal. This ruling was given in 2018 by scholars from the bureau. This means that Muslims are allowed to invest in cryptocurrencies as per Islamic law.

While many Islamic scholars agree that cryptocurrency is currently haram (forbidden), there is some debate on the topic. Some believe that cryptocurrency is only haram if it is used for speculative purposes, while others believe that any use of cryptocurrency is haram. Indonesia, the world’s largest Muslim-majority country, has banned cryptocurrency trading. This is likely due to the fact that the Indonesian government does not want to encourage any activity that is considered haram.

Is 401k halal or haram?

There are a few conditions that must be met in order for a 401(k), SEP-IRA, SIMPLE, or other workplace retirement plan to be halal. First, the company’s investment options must comply with Islamic law. This means that the company cannot invest in things like alcohol, gambling, or pornography. Second, the company must offer a retirement plan that is available to all employees, regardless of their religion. Finally, the company must allow employees to opt out of the retirement plan if they so choose.

Halal investing is a type of investing that is in line with Islamic principles. This means that businesses that are involved in activities that are prohibited by Islam, such as earning interest on debt, are off-limits for Halal investors. This can make finding appropriate investments a challenge for observant Muslims, but there are a number of options available that can provide good returns while still being compliant with Islamic law.

What are halal things to invest in

There are four common Halal investment options: stocks, businesses, real estate, and cash.

Halal stocks are those that comply with Islamic law. This means that the companies must avoid any activity that is considered haram, or forbidden. Haram activities include gambling, alcohol, and pork production.

There are a few ways to find halal stocks. First, you can look for companies that have been certified by an Islamic organization. Second, you can screening companies yourself using publicly available information.

Businesses can also be a halal investment. The key is to ensure that the business is engaged in halal activities. For example, a halal restaurant would avoid serving alcohol or pork.

Real estate can also be a halal investment, as long as the property is not used for haram activities. For example, a halal hotel would avoid having a bar on the premises.

Finally, cash is a halal investment option. This includes savings accounts, bonds, and other interest-bearing accounts. The key is to make sure that the institution where you are investing is not using your money in haram activities.

The Quran prohibits gambling because it is a form of usury, which is forbidden in Islam. Gambling is a game of chance that typically involves wagering money on the outcome of an event, such as a dice roll or a horse race. The Qur’an views gambling as a form of gambling and therefore as a form of usury, which is prohibited in Islam.

Is Amazon stock halal?

According to Sharia, Amazon’s stock is not Shariah-compliant because it sells foods that contain alcohol, pork, and tobacco, and it also provides access to non-permissible entertainment content.

Assuming the above is true, then it seems that Apple is a halal company overall. This is based on the percentage of non-shariah compliant business activities compared to total revenue. If the non-shariah compliant business activities were to increase, then there’s a chance that Apple would no longer be considered halal.

Is buying and selling NFT halal

NFTs are Shariah compliant as long as the underlying asset is compliant. However, if an artist makes an NFT composed of something non-compliant or with potential extraneous issues, it could place you at risk of Shariah non-compliance.

This is a difficult question to answer definitively. Some people argue that Google (GOOGL) is a halal stock, while others label it as questionable. The reason for this is that although the business model is shariah-compliant, some of its revenue is generated from haram sources (such as interest). Ultimately, it is up to the individual to make a decision on whether or not they believe investing in this company is permissible.

Is Netflix a halal stock?

Many Islamic finance scholars have agreed that entertainment is one of the non-permissible businesses. Therefore, Netflix doesn’t pass the Shariah-compliant assessment. There are several methodologies to determine the halalness of a stock, and Netflix fails under all of them.

In Islam, there is a concept of halal (permissible) and haram (forbidden). When it comes to cryptocurrency, Bitcoin, Ethereum, and Dogecoin are considered halal, while Shiba Inu (SHIB) token, Alpha, and PancakeSwap (CAKE) are considered haram. This is because Shiba Inu (SHIB) token, Alpha, and PancakeSwap (CAKE) are based on the concept of riba (interest), which is not permissible in Islam.

Final Words

The simple answer is that yes, investing is haram in Islam.

There are many hadiths which forbid investment, such as:

“Do not devour one another’s wealth unjustly” (Bukhari)

“No one should take anything from another by force” (Abu Dawood)

“Whoever eats his brother’s flesh, Allah will forbid him from entering Paradise” (Ibn Majah)

“There is no usury, but only righteousness and sin” (al-Bukhari, Muslim)

“Those who engage in usury will be raised on the Day of Resurrection like the one who rises from his grave with his clothes and hair dishevelled” (al-Bukhari, Muslim)

“Usury has seventy segments, the least serious being equivalent to murdering one’s own mother” (al-Bukhari, Muslim)

“The usurer is the enemy of Allah, His Messenger and those who believe. Allah curses him and curses those who take usury” (al-Bukhari, Muslim).

So, as you can see, investment is considered to be a form of usury and is therefore haram.

Based on the teachings of the Quran and Hadith, it is clear that investing is haram in Islam. This is because investing involves taking a risk with money that could potentially lead to a loss, and Islam strictly prohibits gambling. Additionally, many types of investments are based on interest, which is also prohibited in Islam. Therefore, it is best to avoid investing altogether if you are Muslim.